A brand new Group Private Accident (GPA) coverage linked to State Financial institution of India (SBI) is gaining consideration in February 2026. The headline sounds nearly unbelievable:

₹60 lakh accident cowl for simply ₹3,000 per yr (~₹8.20 per day).

However earlier than you rush to enroll, let’s break this down rigorously — what it covers, what it doesn’t, and whether or not it is smart for you.

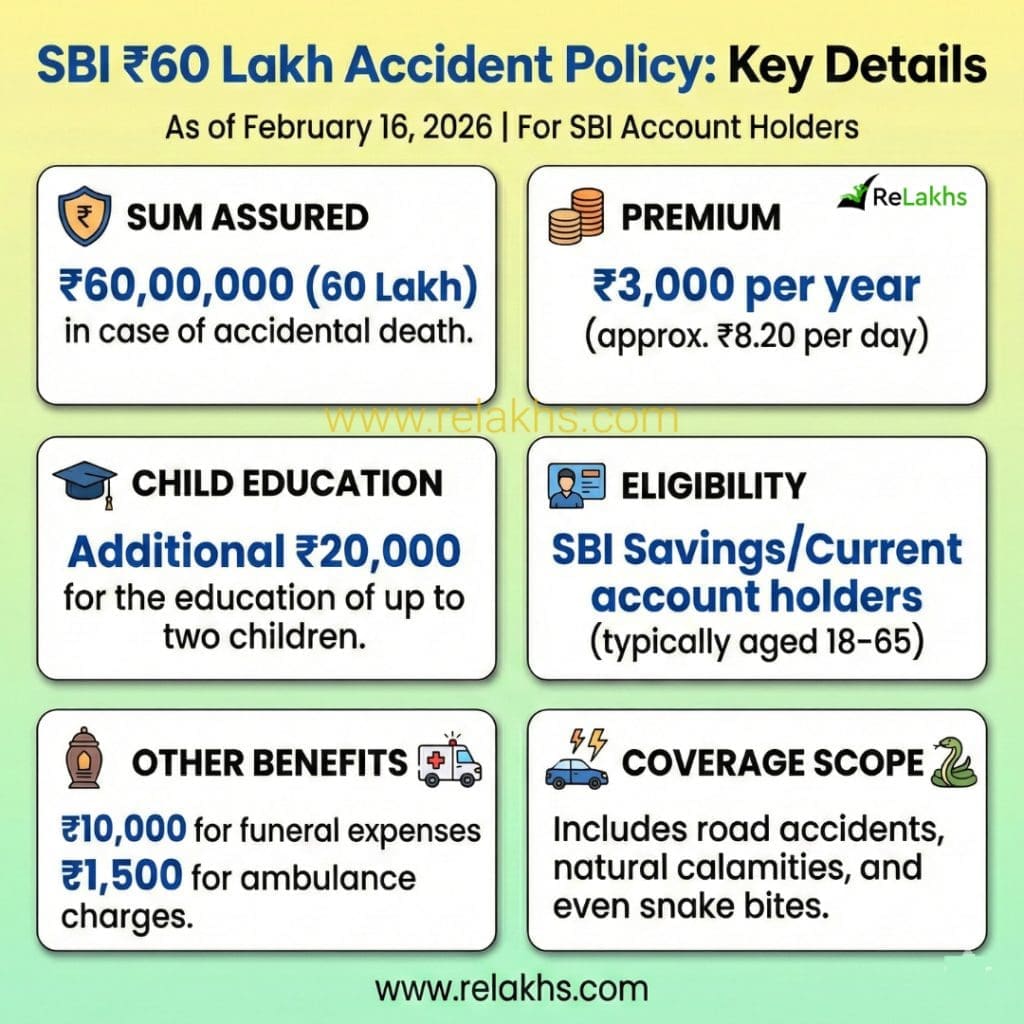

Key Options of the SBI ₹60 Lakh Group Private Accident Coverage

- Sum Assured: ₹60,00,000 (for unintended dying)

- Premium: ₹3,000 per yr (~₹8.20/day)

- Eligibility: SBI financial savings/present account holders (18–65 years usually)

- Extra Advantages:

- Little one schooling profit (as much as ₹20,000 per little one, max two)

- Funeral bills (₹10,000)

- Ambulance costs (₹1,500)

- Protection Scope: Contains street accidents, pure calamities, and even snake bites.

- Exclusions: Like most accident insurance policies, this does not cowl pure dying, suicide, or accidents occurring inebriated or medicine.

How you can enroll for SBI’s Rs 60 lakh Private Unintended Coverage

If you wish to enroll on this particular ₹3,000/yr plan:

- YONO SBI App: Navigate to the ‘Insurance coverage’ part and search for Group Private Accident Insurance coverage.

- Department Go to: You’ll be able to submit a one-time “Auto-Renewal” consent type at your private home department.

- Computerized Debit: As soon as opted in, the ₹3,000 premium will likely be mechanically deducted out of your account yearly.

How you can Declare Loss of life Profit beneath SBI’s new Private Accident Plan?

In case of unintended dying:

- The nominee should inform the SBI department the place the account is maintained.

- A dying certificates should be submitted to the department.

- Supporting paperwork equivalent to accident reviews, FIR (if relevant), and declare kinds might also be required.

- After verification and declare approval, the ₹60 lakh sum assured will likely be deposited immediately into the nominee’s checking account.

So, it’s advisable to tell members of the family about:

- The existence of this coverage

- The department particulars

- Nominee registration standing

Group Private Accident (GPA) vs Particular person Private Accident (IPA)

Kindly bear in mind this can be a Group Accident Plan and never a person private accident plan.

A Group Private Accident (GPA) coverage is an insurance coverage plan supplied to a gaggle of individuals — on this case, SBI account holders.

As an alternative of shopping for a person plan, you get protection by the group. It often has:

- Decrease premium (cheaper than particular person plans)

- Mounted advantages (can’t customise like particular person plans)

- Computerized protection so long as you might be a part of the group

On this case, the SBI ₹60 lakh plan offers unintended dying cowl at ₹3,000/yr (~₹8/day) for those who decide in. The important thing variations between GPA and IPA are;

| Characteristic | Group Plan (e.g., SBI) | Particular person Plan |

|---|---|---|

| Premium | Considerably Decrease | Increased |

| Continuity | Ends for those who go away the group | Continues so long as you pay |

| Customization | None (Mounted advantages) | Can add riders (Fracture cowl, Incapacity, and so forth.) |

| Declare Course of | Usually managed through the Financial institution | Direct with Insurer |

Why it’s sensible to take Rs 60 Lakh SBI Unintended Insurance coverage Coverage?

- Extraordinarily Low Price: Rs60 lakh cowl at ₹3,000/yr affords a robust cost-to-benefit ratio.

- No Medical Underwriting: Group plans often don’t require medical checks.

The Dangers & Limitations (The Cons)

- The protection is tied to the SBI group association. When you shut the SBI account or phrases change, protection could finish.

- It’s a mounted sum assured plan. You can’t customise the sum assured quantity and can’t add some other advantages or riders.

- Bear in mind this isn’t a time period insurance coverage and the insurance coverage cowl excludes pure dying or sickness associated dying. So, this can be a complement, not a substitute to time period insurance coverage and medical health insurance cowl.

In case you are an SBI account holder and presently would not have any private accident cowl, this ₹60 lakh group coverage is value contemplating.

At ₹3,000 per yr, it offers a big security web at a really low value.

Simply bear in mind — it ought to complement, not change, your time period and medical health insurance.

Proceed studying:

Notice: The knowledge on this article relies on presently accessible knowledge and could also be up to date or revised as extra particulars emerge.

(Put up first revealed on : 16-Feb-2026)